Private Credit to Small Borrowers Booms With Less Competition

In the $850 billion private debt market, it’s the jumbo deals that tend to get the most attention. But the smaller transactions, to mid-size businesses that employ a large swath of Americans, make up most of the activity in the asset class. Looking ahead at the remainder of 2020, the lower middle-market — broadly classified…

Read MoreMeet Marc Cole, Co-Founder and CEO of SG Credit Partners, Inc.

SG Credit Partners provides situational capital ranging from $1-$10 million for the lower middle market with a focus on non-sponsored businesses. Headquartered in Southern California with offices in Atlanta, Boston, Chicago and Portland, the SG Credit Partners team has provided in excess of $250 million to 150-plus borrowers across a variety of industries and continues…

Read MoreThe Day the Music Died in Special Assets

2010 is the day the music died in special assets departments around the country. That’s the day that the Office of the Comptroller of the Currency (OCC) descended upon the big banks, especially special assets groups, and changed the rules by literally re-writing the playbook. What playbook you ask? Today each special assets group within…

Read MoreInnovation, Competition and Consolidation in the Non-Bank Small-Ticket ABL Space

The sub-$10 million ABL facility space has long been a paradox. Over the years, new capital providers have entered only to chase too few loans, while incumbent asset-based lenders shift and migrate strategy. This creates a shortfall of good assets, and the cycle continues. But it’s not always that easy. Right now, we sit in…

Read MoreWhy do Small Community Banks Struggle with ABL?

One unexpected result of COVID-19 is the reexamination of asset-based lending initiatives by community banks. Smaller (sub-$10 billion) community banks have been exiting or evaluating an exit from ABL before they really gave it a shot. It should be noted that most entered during a great economy in preparation for a downturn, yet many decided…

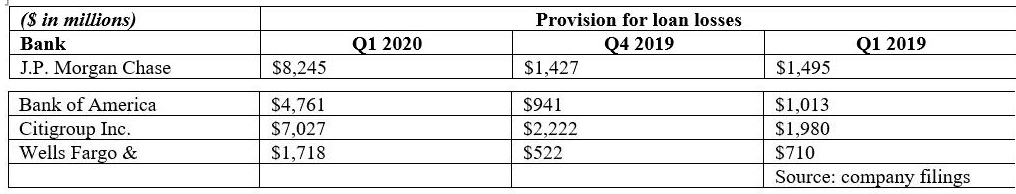

Read MoreBig banks’ best defense in a pandemic: A diversified strategy

Combined arms is a warfare strategy used by the military which seeks to integrate complementary assets in a common mission to achieve decisive effects. It turns out a similar strategy is being used by big banks these days. On the front lines, a good military (bank) wins when it effectively combines complementary assets as most…

Read MoreThe Empire is About to Strike Back: Non-Bank ABLs are Ready for Action

In the 1980 movie, “The Empire Strikes Back,” the “dark side” (non-bank ABLs) forces mount an attack against Luke Skywalker to strike back. Much like in the movie, the “Empire” has been waiting to strike back against the banks (including bank-ABLs). In my most recent article, “Up in the Air,” I discussed the freezing of…

Read MoreAftermath

Aftermath means the consequences or aftereffects of a significant unpleasant event, like Covid-19. The financial system is going to experience this first-hand. No firm, whether it be bank or non-bank, will be left unscathed. The author is purposely writing this article now in order to predict that one of the many untold stories will be…

Read MoreSG Continues to Provide Structured Credit Solutions in Today’s Environment

Today’s environment has led to delayed M&A transactions, delayed capital raises, and limited access to bank / senior lender credit, which has created liquidity needs for many lower middle market businesses across the country. While these businesses scramble to gain access to liquidity via existing lenders and the SBA (and other federal, state, and local…

Read MoreUp in the Air

George Clooney starred in the financial crises era movie, “Up in the Air,” that we in the commercial finance industry are all about to live through with one big exception. The asset-based lending (ABL) industry was the sector of commercial lending that was supposed to be the “George Clooney” sent in to provide liquidity and…

Read More